Christa Andrews, Alabama State Coordinator at BAEO, discusses CER’s ‘F’ grade on AL’s Tax Credit Scholarship program. Under the Alabama Accountability Act, low income students not in failing school systems can be considered for scholarships but only after families in failing schools are considered.

How Does Florida’s Expanded Tax Credit Scholarship Law Compare Nationally?

Arianna Prothero, Education Week

Although Florida has significantly raised the eligibility caps on its tuition tax-credit scholarships to include more middle-income families, it is still far from the most generous program in that regard nationwide.

Tuition tax-credit laws allow businesses or individuals to claim tax credits for donations made to approved scholarship organizations which then distribute money to eligible students. Opponents charge that such programs siphon money away from public schools and into private, religious schools.

‘Solidly Middle Class’

Starting in 2016, students from Florida households making about $62,000 a year (260 percent of the federal poverty level) will be eligible for tax-credit scholarships, although the amount of the scholarships will vary based on family income levels. Currently, Florida law caps the program at roughly $44,000 annually which is just below the median yearly household income of about $47,000 according to the most recent U.S. Census estimates.

With the higher income cap, the tax-credit scholarships have moved well into the realm of being a school choice policy for both low- and middle-income families.

“I would say $60,000 fits in the middle class,” said economics professor Sean Snaith with the Orlando-based University of Central Florida. “It’s not going to get you a house in Miami, but there are many areas, particularly rural, where that’s solidly middle class.”

This income-cap creep is not unpredictable. Many tax-credit scholarship and voucher programs start off serving disabled or low-income students and then expand, says Chris Lubienski an education policy professor at the University of Illinois Urbana-Champaign.

“It’s a foot-in-the-door strategy we’ve been seeing,” he says. “You start such a program for a […] population that is underserved, and then you start expanding from there.”

Low Caps, High Ranking

However, among the 14 states that have tax-credit scholarship programs, several set much higher income caps than Florida’s.

Brace yourself: We’re not done with the numbers yet.

For example, a family of four in Oklahoma has to make 300 percent or less of the eligibility level for the federal free and reduced lunch program, which is roughly $130,000 a year, to qualify for an education tax-credit scholarship, while in Georgia and South Carolina there is no income limit at all, according to data from the Center for Education Reform, a school choice advocacy and research group in Bethesda, Md.

“Florida’s previous eligibility level of 185 [percent of] the federal poverty rate tied the state for the most-restrictive participation limit,” says CER senior policy advisor Brian Backstrom. “The broader reach offered under the higher income-eligibility limit moves it only to 11th place out of the 14 states.”

Other areas of Florida’s law are more generous: The state has a system in place to automatically increase the number of available tax-credits by 25 percent if 80 percent of the credits are claimed in the previous year. Florida awarded 100 percent of its credits last year.

The CER recently awarded Florida an “A” for its tax-credit laws, ranking it only second nationally behind Arizona.

NEWSWIRE: June 24, 2014

Vol. 16, No. 25

For two decades, charter school leaders, parents and educators have forged ahead to deliver the promise of a better educational opportunity for our nation’s children in the face of relentless attacks. In light of a Detroit Free Press series calling for more charter school oversight, it has once again become necessary to set the record straight surrounding the high-demand schools that serve over 2.5 million students and counting.

CHARTER SCHOOLS ARE PUBLIC SCHOOLS. Regular readers of Newswire are acutely aware of this fact, but it bears repeating amid recommendations for inordinate amounts of scrutiny that undermine charter schools. Increased accountability is one thing, yet those calls never seem to be echoed when it comes to securing equitable resources for charter students compared with their traditional school peers. Disproportionate treatment of charter schools allows opponents to perpetuate the mindset that charters are unwelcome outliers of the public system. More regulation in the name of oversight would misguidedly destroy the very autonomy and freedom families sought out in the first place.

CHARTERS ARE ACCOUNTABLE FOR RESULTS. The hallmark of charter schools is performance-based accountability. Through a wide range of management structures and mission statements, charter schools not only adhere to state standards, but are driven to deliver results knowing full well closure is a distinct possibility, and that families can vote with their feet by leaving the school at any point in time. It is for this reason that charter schools are accountable to families first and foremost. The research shows both in Michigan and across the states that charter schools deliver substantial learning gains in math and reading. Accountability in education can never be truly achieved without parental choice, and charter schools are just one way in a vast mixture of alternatives to deliver that promise.

CHARTER SUCCESS IS CONTINGENT ON STRONG LAWS. Of course, the laws and safeguards are one of the biggest determinants of whether or not charters function in an environment where they can thrive. Ethics regulations to which charter schools are already subject accomplish nothing to lift student outcomes and replicate existing laws that address malfeasance. Instead, charters operate best under independent authorizers, usually in the form of universities that have a vested interest in student success. Central Michigan University epitomizes the university authorizer model, equipped with the resources and infrastructure to hold educators and school leaders accountable, allowing it to oversee a large multitude of successful schools.

CHARTERS ARE UNDERFUNDED. On average, charter schools nationwide are underfunded by 36 percent less than traditional public schools. A major obstacle particularly in Michigan is a lack of dollars for charter school facilities, meaning dedicated operators often have to become creative and improvise to secure an adequate learning space for students. In some cases, this means partnering with organizations that make categorically high-risk investments into schools intended for underserved students. Not exactly the most surefire way to take care of the bottom line, but it’s achieved through increasing student achievement. The ability to do more with less public resources speaks volumes about the dedication of charter operators, and should open the door for a conversation about how these schools could serve even more students with funding equity.

NEWSWIRE: June 17, 2014

Vol. 16, No. 24

CREDIT WHERE CREDIT’S DUE. In the past three years, there has been a rapid creation of tax credit-funded scholarship programs across 14 states. Eager to determine whether these programs were actually increasing parental access to more and better educational choices, CER conducted a ranking and state-by-state comparison to encourage best practices. Some states (Arizona and Florida) not only cast a wide net in terms of funding and student eligibility, but also follow through in actually implementing the program. While their tax credit programs may not be at the bottom of the barrel in terms of structure, actual implementation in other states (looking at you, Louisiana) is not delivering on the promise. At the end of the day, lawmakers should ask the question of how to best expand parental choice, and sound tax credit scholarship programs are one option in what should be a diverse portfolio of educational opportunities that can continue to boost student outcomes. Read the full report here.

VERGARA VICTORY STILL SHINING. The huge victory for both students and educators in Vergara v. California has not only stimulated governmental action across the states, but has also served as a catalyst for a conversation surrounding what’s best for students while honoring teachers as professionals. The clear and unequivocal nature of the Vergara ruling affirming equality of education as a civil rights issue has highlighted the types of antiquated employment practices that defy common sense and what’s best for students. Unions are fighting the current policy shift in favor of more accountability in schools, and Generalissimo Francisco Franco is still dead. And unions are miraculously doing it without actually mentioning policy terms such as ‘tenure’ and ‘seniority’ (can’t have that pesky veil lifted). Vergara may have originated in a state judiciary system, but has now officially been brought to the court of public opinion, and it’s winning that battle too.

RAISING ARIZONA. A very happy 20th anniversary to Arizona’s charter school law and all of the pioneers who helped make it happen. As it stands now, this southwestern bastion of Parent Power has the fifth strongest charter law in the nation. In addition to multiple, independent charter authorizers, charter schools in Arizona are supported by teacher autonomy, the absence of a cap on schools created, and assistance with facility funding. Whether applied to charter laws or school choice as a whole, it’s clear Arizona appreciates the importance of structuring policies correctly to maximize the number of families who stand to benefit from choice, as they also earn an “A” on CER’s new education tax credit scholarship ranking & scorecard, out today!

LET’S GET DIGITAL. CER wasn’t the only group to release a report today encouraging innovation at the state policy level. A new report from the Aspen Institute prescribes ways on integrating technology to help students best master learning content and adapt to newly available resources. Two key things the report accomplishes is recognition of the urgency with which we must act to improve a stagnant education system, and how digital learning can be part of that solution. Similar to tax credit scholarship programs and school choice overall, online learning options have proliferated rapidly in recent years, allowing students to engage in a form of education best suited to their needs.

SENIOR SIGNING DAY. In a crowded auditorium, graduating seniors of Democracy Prep in New York City walked out onto the stage, introduced themselves and the college where they’ll be attending next fall, at which point each graduate was promptly met with resounding applause. It’s one of the more inspirational spectacles in education today, and a demonstration of the positive role charter schools are playing in New York and elsewhere. Unsurprisingly to anyone familiar with the high expectations and positively rigorous Democracy Prep academic program, it takes more than a few minutes to get through all the students. While policy reports are critical in providing guidance on best practices, it’s critical to provide reminders of the real results of school choice and innovation.

Center for Education Reform gives Alabama Accountability Act scholarship plan an F

Mike Cason, The Hunstville Times

MONTGOMERY, Alabama — A national group that promotes tax-credit funded private school scholarships gives the scholarship plan created under the Alabama Accountability Act a grade of F.

In a report released today, The Center for Education Reform rated Alabama’s law weakest among 14 states that it said have such programs.

The report from the center, which supports school choice and charter schools, did not fault the accountability act for the reason critics usually do — that it diverts tax dollars from public to private schools.

The report rated Alabama’s law poorly because it said the plan will limit participation.

Under the accountability act, donors pay for the scholarships by giving to scholarship granting organizations. Donors get a credit on their state income taxes. Those are income tax dollars that would otherwise go to public education.

The accountability act caps the total income tax credits at $25 million a year. The center’s report praised other states, including Arizona and Florida, that allow their caps to rise based on demand.

The report also criticized Alabama’s law because it places many requirements on the private schools that accept the scholarships.

The center faulted Alabama for allowing scholarships only to students from public schools labeled as failing. But that’s partly wrong. Students from any Alabama school, public or private, can receive scholarships if the scholarship organizations have money left after Sept. 15 each year.

The accountability act does place an income limit on eligibility — up to 150 percent of the state median income. The median is about $41,000.

The Center for Education Reform, based in Washington, D.C., said tax-credit funded scholarships pay tuition for about 190,000 students nationally.

As for the criticism that the programs hurt public school funding, the report says the lost revenue is often less than the state would spend per pupil. “A significant benefit of these scholarship programs is to shift the power of choosing a child’s education from the government to the child’s parent,” the report says.

Half of the states with scholarship programs set them up within the last three years, the report said. Alabama’s law passed in 2013.

Here’s how other state laws graded:

A — Arizona and Florida. The report said Arizona’s law encourages the greatest participation by students and donors, with an automatic escalator that increases the tax credits allowed by 20 percent each year the maximum is reached.

The report praised Florida’s law for increasing the income eligibility level, dropping a requirement that only public school students are eligible, and having an automatic escalator clause of 25 percent if at least 80 percent of allowed credits are claimed.

B — Georgia, Pennsylvania, Indiana and Virginia.

C — Iowa, New Hampshire, South Carolina, Louisiana and Oklahoma.

D — Rhode Island and Kansas.

The report also ranked the states on participation and implementation, but said that programs in Alabama, South Carolina and Kansas are too new to evaluate.

Alabama’s law faces a state court challenge.

Montgomery County Circuit Judge Gene Reese ruled last month that the law violated the state constitution because of the secretive way it passed the Legislature, because it violates a constitutional requirement that income tax revenue be used only for public school teacher salaries and because it violates constitutional restrictions on tax dollars going to private schools and charitable organizations.

The state and parents who intervened in the case are appealing to the Alabama Supreme Court.

Reese issued an injunction against further use of the law but agreed to lift that while the appeal is pending.

Two previous lawsuits that attempted to block the AAA failed.

From Arizona to Alabama: Ranking the Country’s Education Tax-Credit Laws

Arianna Prothero

Education Week

June 17th, 2014

Arizona and Florida have the strongest education tax-credit scholarship programs in the country while Alabama’s law is the weakest according to a ranking released today by the Center for Education Reform, a school choice advocacy and research group.

The Bethesda, Md.-based CER assigned letter grades to the 14 states that have enacted education tax-credit laws, which allow businesses or individuals to claim tax-credits for donations made to approved scholarship organizations, grading them based primarily on how well funded each program is and how many students they serve.

Teacher Union Wordsmiths

Mike Antonucci, Intercepts

I went over the press releases and statements on the Vergara decision from the various teachers’ unions and have drawn a few inferences about their communications strategy going forward. The language used – and omitted – appears to be highly crafted, polled and focus-grouped.

The NEA press release and statement from president Dennis Van Roekel includes in the first two sentences the words “multimillionaire,” “ultra-rich,” “deep-pocketed,” “corporate” (twice), “special interests,” and “privatizing.”

Missing from the statement are the words “seniority” or “tenure” (or its stand-in, “due process”). Instead there are two references to “experience,” which signals the angle NEA will probably take.

AFT president Randi Weingarten had a different emphasis. She mentioned “due process” and “teacher protections,” but also omitted “tenure” and “seniority.”

She did not use “corporate” at all and “wealthy” only once, but money was in her message. She referenced “budget crises,” “full and fair funding,” “funding inequities” and “high poverty.”

The California Teachers Association referred to “professional rights,” “these laws” and “challenged statutes” in lieu of “tenure” and “experience” in lieu of “seniority.” CTA focused on the conduct of the trial itself, though it also mentioned “millionaire” and “corporate.”

The California Federation of Teachers emphasized “taking away rights from teachers.” CFT followed Weingarten’s lead in “underfunding, poverty, and economic inequality,” but mirrored NEA in using “experience.” CFT did mention “due process,” but did not use “seniority” or “tenure.”

The outlier is the Chicago Teachers Union and its president, Karen Lewis. CTU used “tenure” prominently in its press release and spent a lot of space defending it. Much of the statement deals with the “calculated deprivation of resources.” Seniority is not mentioned.

My view of all this is that the unions will, as they have in the past, score well with the general public when attacking evil corporate puppetmasters. But judging from the media reports of the Vergara ruling – almost all of which prominently use “seniority” and “tenure” – they will have an uphill battle altering the public perception of protecting bad teachers.

Regardless of merits, in communications whichever side has to do the explaining is the side that loses. The legal process will be long and drawn-out. The PR process will be immediate and unrelenting.

Lay out the welcome mat for charter schools

Kara Kerwin, Frederick News Post

On the campaign trail back in 2010, former Maryland Gov. Bob Ehrlich conceded that Maryland’s charter school law did not go far enough in creating the necessary safeguards for a thriving charter sector statewide, and more needed to be done to ensure charter schools become a welcomed part of public education.

Four years later, Frederick Classical Charter School is coming to terms with this revelation, as administrators are hitting roadblocks in efforts to secure equitable funding for their students — students who deserve the same resources as students in other public schools.

Upon receiving funding for the upcoming fiscal year from Frederick County Public Schools, Frederick Classical realized a disparity in transportation money, a category under which the school is entitled to receive funding, according to state law. Moreover, Frederick Classical, whether in its initial charter agreed upon with local authorities or subsequently, never forfeited rights to receive such funding. School leaders know full well that any such acknowledgment would potentially undercut critical resources for students.

Now, Frederick Classical must find ways to make up for the shortfall in the most efficient way possible, an unfortunate predicament with which charter schools nationwide are sadly all too familiar.

Maryland’s charter school law is particularly weak, especially when it comes to funding. According to state law and by the direct admission of the state Board of Education, charter school students are not entitled to equitable funding, but, rather, whatever “commensurate” per-pupil formula the local district chooses to apply. This inevitably leads to students in some schools receiving more resources than others, a concept so morally corrupt it’s a wonder how it continues to be tolerated.

The state Board of Education has virtually no authority when it comes to chartering matters. Without multiple independent charter authorizers such as universities that have proven track records of successful charter oversight and accountability in other states, local districts wield unbridled power over funding and operational decisions.

Because Maryland’s charter school law has not been updated to follow best practices, all of these problems are now playing out in Frederick. This situation should be an eye-opener for lawmakers to realize that Maryland’s charter law needs to change to ensure all students, regardless of what type of public school they attend, deserve better, and so contentious situations like these can be avoided in the future.

In the meantime, the onus is on local officials to acknowledge flawed external conditions, and respond to the realities on the ground. There should be an objective among all parties involved to work together and do what’s necessary to give a positive educational experience to all students, including those who attend Frederick Classical.

The district is entirely within its power to adjust the per-pupil allotment, and Frederick Classical is entirely eligible to not only receive equitable funding but also more than capable to use it effectively.

A willingness to collaborate and overcome a systemic problem, which requires the attention of state lawmakers to remedy through structural change in the charter law, would not only represent bold leadership, but also create an overall positive environment for all schools in Frederick County, both charter and traditional.

Like many other local school leaders, the founders of Frederick Classical are dedicated members of the community with the genuine goal of presenting a viable school for students who could benefit from their learning model. Like many other charter schools that strive to fill an educational niche, Frederick Classical relies on the local support of families, to whom educators and administrators are accountable, first and foremost. After undergoing a multi-year-long application process, Frederick Classical opened its doors with local approval in August 2013.

Frederick Classical’s school motto is “Nil sine magno labore,” or, “Nothing without great labor.” Truer words have never been spoken.

Kara Kerwin is president of the Center for Education Reform, based in Washington.

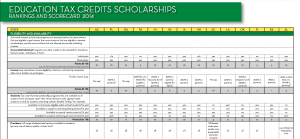

School Choice Today: Education Tax Credit Scholarships Ranking & Scorecard 2014

Out of 14 states that have tax credit-funded scholarship programs, two earn A’s, five earn B’s, four earn C’s, two earn D’s, and one earns an F on a new ranking and analysis from the Center for Education Reform (CER), School Choice Today: Education Tax Credit Scholarships Ranking & Scorecard 2014.

The first of its kind, the Education Tax Credit Scholarships Ranking & Scorecard 2014 is an in-depth analysis and state-by-state comparison of the 14 tax credit-funded scholarship programs currently in existence.

Click here to read the School Choice Today: Education Tax Credit Scholarships Ranking & Scorecard 2014 report

Click here for the Education Tax Credits Scholarships Ranking & Scorecard 2014 chart

The World Cup and Education: A Common Bond

The 1990 World Cup in Italy marked the first time in 40 years that the U.S. Men’s National Team played in soccer’s biggest international tournament.

Over the last two decades, the U.S. has played in every World Cup since, and draws in record ratings as many Americans rediscover their newfound interest in soccer every four years.

And during that time, some American soccer players such as Landon Donovan or Alexi Lalas have become more or less household names. Based on the absolutely ankle-shattering move to facilitate the first goal against Ghana in the US opening match, Clint Dempsey is probably next in line.

Like American interest in soccer, education reform policies have also taken shape over the last couple of decades, from the increasing popularity in opportunity scholarship programs, https://edreform.com/2013/12/americas-attitudes-towards-education-reform-public-support-for-accountability-in-schools/ to the increased foothold of charter schools. While parental interest in their child’s education is nothing new, parents and community members have taken a newfound consideration in how these new innovations can boost opportunities for students.

As the U.S. team and individual players continue to gain traction in the eyes of the American public, so have large and small charter operators and school choice movements across the states. https://edreform.com/in-the-states/map/

Many Americans view the game of soccer as a slog. It’s a drawn out, seemingly futile exercise that stays the same for most of the time, with intermittent bursts of excitement and success.

Those who have tried — and continue to try – to create choice and accountability in schools can likely relate to the sentiment that comes with efforts of trying to shake up an otherwise static system.

Soccer and education share a common notorious bond in the sense that both contain an inordinate amount of players who flop and then feign injury to gain unfair advantages against those who flat out play better.

Supporters of the toxic California tenure policies overturned in Vergara v. California https://edreform.com/2014/06/california-court-affirms-student-rights/ amount to the Oscar-worthy World Cup competitor who writhes on the ground for a nonexistent injury.

U.S. Coach Jurgen Klinsmann has said the squad is still in building mode, but has high expectations for the future.

Education Reformers could say the same.